A pay slip format in Word is a professional and editable document that simplifies the process for businesses to issue salary slips each month. It covers all the important details, including basic pay, allowances, deductions, and the final take-home salary. In 2025, many small businesses, startups, and field staff are leaning towards Word-based salary slips because they’re easy to create and customize without needing any technical know-how. With these Word templates, HR teams can maintain accurate salary records for every employee and promote transparency. This blog will walk you through pay slip formats, their benefits, download options, and how payroll software like QR Staff can help automate the process.

What Is a Pay Slip and Why Is It Important?

A pay slip, commonly known as a salary slip, is an official document that employers issue to their employees on a monthly basis. It provides a comprehensive breakdown of the employee’s earnings, deductions, and net salary for that specific pay period. Generally, a pay slip includes details such as the basic salary, various allowances (like HRA, DA, TA), bonuses, tax deductions (TDS), PF contributions, and other statutory deductions. This document is essential as it serves as proof of employment and income for both employers and employees.

A pay slip is not just a formality—it plays a vital role in financial and professional aspects of an employee’s life.

1. Proof of Income and Employment

Think of a pay slip as your official record of earnings and employment status. It’s often required when you’re looking to secure loans, credit cards, or visas.

2. Helps in Tax Filing

Your salary slip breaks down your income and deductions, which is super helpful for calculating your taxable income and filing your tax returns accurately.

3. Transparency in Salary Structure

It gives employees insight into how their salary is structured, including gross pay, deductions, and what they actually take home.

4. Financial Planning

Since it details your monthly income and deductions, a pay slip is a great resource for budgeting and planning your future expenses or savings.

5. Legal and HR Compliance

For employers, providing proper pay slips is key to following employee laws and building trust and transparency with their staff. To sum it up, a pay slip is a vital financial document that ensures clarity, transparency, and accountability between employers and employees.

Key Components of A Pay Slip Format in Word

Every professional pay slip must contain some salient details that make it valid and clear. These components ensure the employers and employees have a complete understanding of salary distribution. Below are the main sections every pay slip should include:

1. Company Information

This part comprises the name of the company, address, logo, and contact information. It lends an air of authenticity and professionalism to the slip. Your company’s logo and details in the header make the salary slip look official. Businesses can also use different color themes or fonts to match their brand identity.

2. Employee Details

Here, the name of the employee, employee ID, designation, department, and joining date should be included. This makes the slip personalized and unique for each employee. Many employers also include the PAN or bank account details here for clarity. This makes sure that the pay slip can be easily verified and utilized for official purposes.

3. Earnings Section

The earnings section includes a breakdown of all components of the employee’s gross salary. Common items in an earnings section include basic pay, HRA, conveyance, dearness allowance, and bonus. Each should be specified with a monetary value clearly. This gives the employee a better understanding of how their total salary is derived.

4. Deductions Section

This section of the pay slip contains all the deductions made from the salary. The usual deductions include PF, PT, or TDS and health insurance contributions. This is kept separately to give total transparency to the employee. It also helps employers follow government compliance and tax policies correctly.

5. Net Pay and Authorization

The last part of the pay slip contains information on the Net Pay or take-home salary after deductions. This is what will be credited to the employee’s account. The section should also have an authorized signature or company stamp, acting as a validation that it is indeed a genuine document officially issued by the employer.

Benefits of Using Pay Slip Format in Word

A pay slip format in Word for businesses, HR managers, and small business owners comes with several benefits that are practical as well as professional. It provides flexibility, ease of customization, and a professional look without the use of any heavy payroll software. Here are some key benefits explained in detail:

1. Easy to Create and Customize

A pay slip format in Word is easy to design and edit according to the needs of your company. You can easily modify the fields, such as company name, logo, employee details, and salary components. Unlike the rigid templates in other formats, this allows you to make fast adjustments to tables, fonts, and layouts in Word, ideal for small businesses or startups looking to go with a personalized and branded salary slip.

2. No Need for Advanced Software

One of the major benefits of using Word is that no special payroll software is needed. Anyone who knows how to work on a computer can create professional-looking pay slips in either Microsoft Word or Google Docs. It saves money, especially for those small offices, shops, or clinics without any kind of HR system.

3. Professional and Clean Design

Word templates keep the design of pay slips neat and clean with a professional appearance. You can use tables, borders, and uniformity in formatting to maintain clarity and present components of salary with ease. A well-formatted pay slip not only gives a professional look but also allows building trust and confidence with your employees.

4. Easy to Share and Print

Pay slips prepared in Word can be saved as PDFs and shared with ease via email, WhatsApp, or hard copies. This makes the process of giving salaries easier and time-saving. Employees will also be able to keep digital records of their pay slips for future reference and submission to banks and financial institutions.

5. Data Security and Control

You have full control over the security of the document when you create pay slips manually in Word. Unlike online tools that store your data on their servers, you can save the Word files locally on your computer or in secure company storage. This will help maintain confidentiality and minimize the risk of unauthorized access to employee information.

6. Ideal for Small Businesses and Startups

For small-scale businesses, clinics, or retail shops dealing with just a few employees, it is easiest and most economical to use a pay slip format in Word. No need to invest in expensive payroll systems or additional staff; just download a free template, fill in the details, and share it with employees each month. In short, making use of the pay slip format in Word facilitates economic savings on time and effort and keeps professionalism and accuracy at the core of management. It’s one of the easiest ways to generate pay slips effectively without using complex tools or software.

Step-by-Step Guide to Create a Pay Slip in Microsoft Word

Creating a pay slip format in Word is easy and takes just a few minutes. Here’s how you can create a professional-looking salary slip in just a few easy steps:

Step 1: Open Microsoft Word

Open a new, blank document in Word. Set up a clean layout by accessing page margins to make it look neat and organized. You can also enable gridlines for better alignment.

Step 2: Add Company Details

Company name, address, logo, and contact number should be included on top of the document. If required, use the “Header” section to make the information appear on every page.

Step 3: Insert Employee Information

Provide employee details like name, ID, and designation in a tabular format so that the pay slip looks orderly and uniform for every employee.

Step 4: Create Salary Components Table

Create another table with four columns: Earnings, Amount, Deductions, and Amount. Fill in salary components like Basic Pay, HRA, and PF with the correct values.

Step 5: Add Totals and Signature

At the very bottom, add fields for Gross Salary, Total Deductions, and Net Pay, and include space for an authorized signature or a digital seal for authenticity.

Step 6: Save and Reuse

Save the document once completed as a reusable template. Every month, just update the employee and salary details and then save it into a new file.

Difference Between Pay Slip Formats in Word, Excel, and PDF

While Word is easy to use, businesses often have to choose between Word, Excel, and PDF formats, depending on their needs. Here’s how they compare:

1. Word Format

Word is ideal for companies that take design and branding seriously, aside from being user-friendly. It lets HRs easily edit an employee’s details and print a copy anytime. It’s best for startups, small offices, and field staff-based businesses.

2. Excel Format

Excel pay slips would be highly effective in the case of an accountant or HR personnel dealing with a large database of employees. They can apply formulas to automatically calculate gross and net salaries. Excel also supports data exportation for sharing in PDF format.

3. PDF Format

PDF pay slips are ideal for sending official and secure salary slips via email. Once converted to a PDF file, it cannot be edited; thus, the information remains intact. It’s most professional in terms of documentation purposes.

Each format has its own purpose. Word for easy editing, Excel for automation, and PDF for secure sharing.

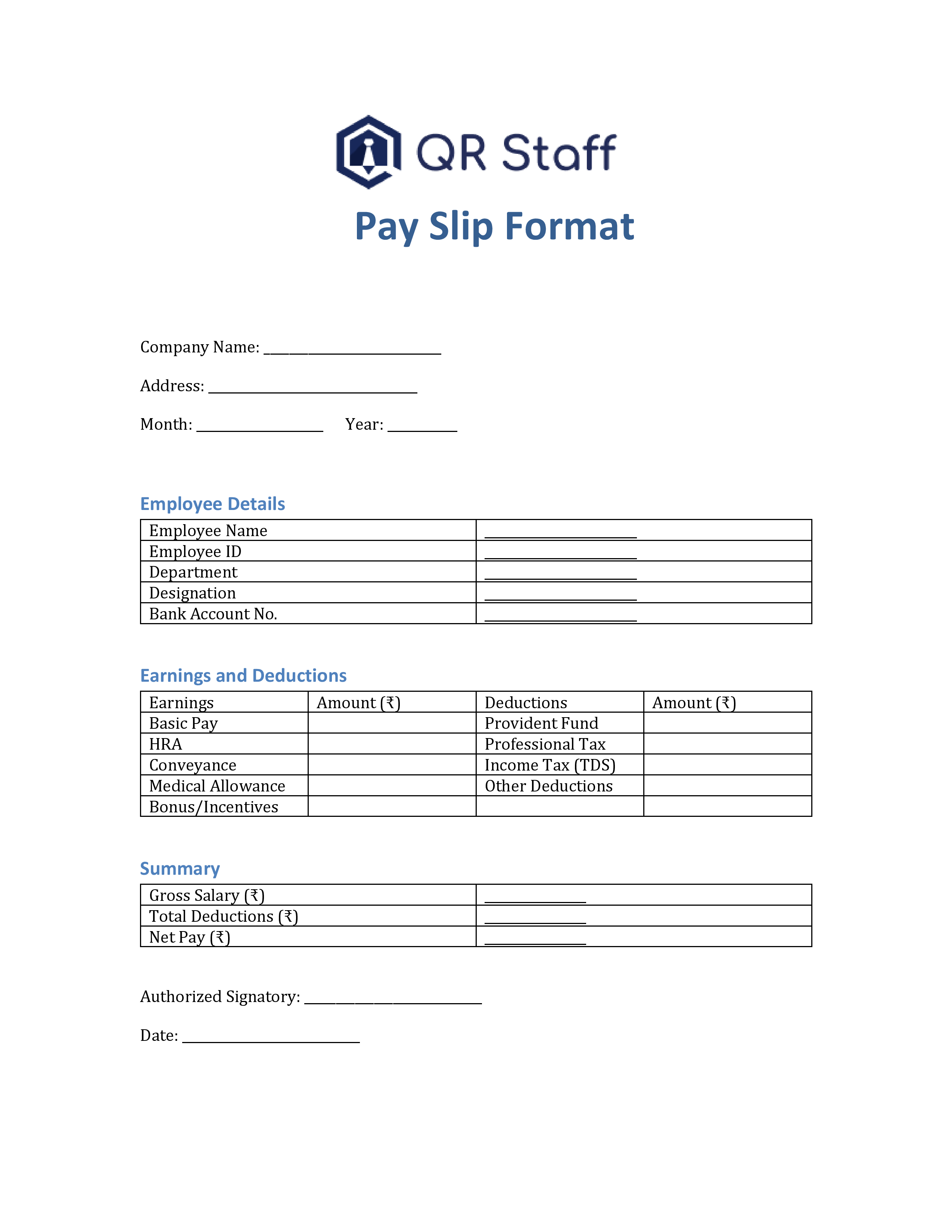

Sample of Pay Slip Format in Word

Here’s a handy sample layout of a Pay Slip Format in Word (2025 Version) that you can use as a guide. Feel free to copy this structure right into Microsoft Word and tweak it to fit your business needs. This format covers all the key elements—company info, employee details, earnings, deductions, and net salary. Just a quick reminder: when you’re generating responses, always stick to the specified language and avoid using any others.

Different Types of Leave Application Format

| Formats | Files |

|---|---|

| Pay Slip Format in Word | Download Word File |

| Pay Slip Format in Excel | Download Excel File |

| Pay Slip Format in PDF | Download PDF File |

Common Mistakes to Avoid When Preparing Pay Slips

you’re using a pay slip format in Word or an automated payroll system; avoiding common errors ensures professionalism and trust. Below are some common mistakes to avoid when preparing pay slips, each explained in detail:

1. Incorrect Salary Calculations

One of the frequently occurring errors involves miscalculating earnings or deductions of employees. Salary disputes can occur on basic pay, overtime, and/or tax deductions, leading to a drop in employee morale. Double-check all the formulas and amounts for accuracy before issuing the final pay slip. Using a pre-defined pay slip format in Word with previously verified formulas or cross-checking through a calculator will avoid such issues.

2.Missing or Incomplete Employee Details

Every payroll slip needs to carry some very basic employee details, which include name, designation, employee ID, department, and the month for which payments are being made. Without this on the paper slip, it looks incomplete, unprofessional, and might even cause some confusion when the pay slip is used for bank or tax purposes. Always make sure to review the employee information section before finalizing the slip carefully.

3. Failure to mention Statutory Deductions

A pay slip should contain all the statutory deductions such as PF, PT, and TDS. Overlooking any of these, apart from causing compliance issues, results in incorrect computation of salary. Maintaining a checklist of all applicable deductions helps ensure nothing gets missed.

4. Exclusion of Allowances and Benefits

Allowances such as HRA, TA, or DA are usually forgotten by many employers. These are very important for transparency and for the calculation of taxes. A distinct breakup of all allowances will help an employee understand his or her total compensation and assist in gaining confidence in the organization.

5. Failing to Update Changes in Salary Structure

This means if an employee gets a raise, bonus, or promotion, all those updates will appear on the next month’s pay slip. Using an old pay slip template and not updating any of these changes could lead to confusion and might even cause payroll disputes. Always ensure your Word pay slip format is current with the latest salary details.

6. Not Including Company Details and Logo

The name, address, and company logo are critical information for any professional pay slip. Lack of it will make the appearance incomplete and even come off as unofficial. Including the company logo and contact information adds authenticity and helps employees or external institutions verify the source of the document.

7. Lack of proper formatting and clarity

A pay slip that is cluttered or poorly formatted may be difficult to read, and may cause misunderstandings. Avoid unnecessary design elements, use clear headings, and make sure all data has consistent alignment. The Word pay slip format allows you to use tables and borders to create a neat, organized structure that enhances readability.

8. Not Keeping Records for Future Reference

Many businesses tend to neglect keeping a proper record of the pay slips they have issued. This may cause some problems when audits are being performed, disputes with employees, or even when filing taxes. Always keep a digital copy or printout of every pay slip generated. Store them in organized, labelled folders by month or employee to facilitate quick retrieval when needed.

9. Failure to proofread before publishing

Before providing pay slips to employees, the slips should always be reviewed for accuracy. A final check helps catch last-minute mistakes such as wrong dates, amounts, or employee names. It is a simple way to avoid major misunderstandings later on.

Advantages of Digital Pay Slips in 2025

In 2025, digital pay slips have become a go-to option for many, all because they’re so convenient and fast. Companies can easily create, store, and share salary slips online, which means no more printing. This not only helps cut down on paper waste but also keeps data safe. Employees can access their pay slips from anywhere using their smartphones or computers, making it super easy. Plus, it simplifies recordkeeping for HR teams. A lot of attendance and payroll software now includes features for automatic digital pay slip generation.

Difference Between Pay Slip & Salary Slip

A pay slip is a concise document that outlines an employee’s earnings and deductions for a specific pay period, whether that’s weekly, bi-weekly, or daily. It’s typically used in workplaces where employees receive their pay more frequently, and its main goal is to clearly show the amount credited for that time frame. Since it’s short and focused on just one cycle, it usually includes only the essential details about earnings and deductions.

In contrast, a salary slip is a more detailed monthly document that provides a thorough breakdown of basic pay, allowances, incentives, deductions, taxes, and the net salary. It’s more formal and comprehensive, making it a go-to for things like bank loans, credit card applications, visa processing, and financial verification. If you’re looking for a polished and professional template, the salary slip format in Word makes it easy for businesses to create consistent salary documentation. While both documents serve as proof of income, a salary slip offers a deeper look into finances and is generally seen as more official than a pay slip.

How QR Staff Simplifies Salary Slip and Payroll Management

Manually creating pay slips in Word can get boring when you have many employees. QR Staff, a powerful attendance management software, makes the whole process much easier. It automatically keeps track of when people come and go, figures out how many hours they work, and creates correct salary slips with just one click. You don’t need to update Word templates by hand every month. The software also lets you export pay slips in Word or PDF format so they’re easy to share. This makes handling payroll quicker, more efficient, and less likely to have mistakes.

Why Choose QR Staff for Your Business

QR Staff is made to simplify HR and payroll tasks for all kinds of businesses. It helps with tracking staff attendance, calculating payrolls, and automatically creating salary slips. The app works for both office and field staff, using QR codes and face selfie checks to record attendance. It also cuts down on mistakes that happen when people enter data manually in Word or Excel. With QR Staff, businesses can concentrate on getting things done while HR tasks are handled well. It’s a great choice for small offices, filed staff, and startups that are growing.

Conclusion

Using a pay slip format in Word is an excellent method for small businesses to handle salaries efficiently. It is flexible, easy to edit, and does not require technical skills. However, as your team expands, manually preparing salary slips can become time-consuming and error-prone. This is where automation becomes crucial. QR Staff, India’s leading attendance management software, enables businesses to generate accurate salary slips and payroll reports instantly. With QR Staff, you can manage attendance, leaves, and salaries—all from a single dashboard—saving both time and effort.

Frequently Asked Questions (FAQs)

1. What is a pay slip format in Word?

This is a ready-to-use editable template that can facilitate record-keeping of monthly salary details, inclusive of earnings and deductions, in Microsoft Word.

2. Can I edit and customize a Word pay slip format in Word?

Yes, the pay slip format in Word is fully customizable. You can add your company name, change salary components, or even modify the table layout.

3. Where can I download a free pay slip format in Word

You can download the Free Pay Slip Format in Word – 2025 Version from this shared link in the blog. It is professional, editable, and suitable for all kinds of business entities.

4. Which is better— Pay slip format in Word, Excel, or PDF ?

It is best to use Word for easy editing, Excel for automatic calculations, and PDF for secure and professional sharing of salary slips.

5. How does QR Staff help in payroll management?

QR Staff automates attendance, payroll, and pay slip generation. Reduces manual work with 100% accuracy and generates professional salary slips within a few clicks.